BLOG: Reaching the Underbanked with The United Account

By Lori Tucker, United Bank's Chief Experience Officer

On November 1, 2021, United Bank launched a new checking account as part of the national Bank On initiative supported by the Cities for Financial Empowerment (CFE) Fund. The United Account provides a safe, affordable transactional bank account that meets the national standards outlined by the Fund.

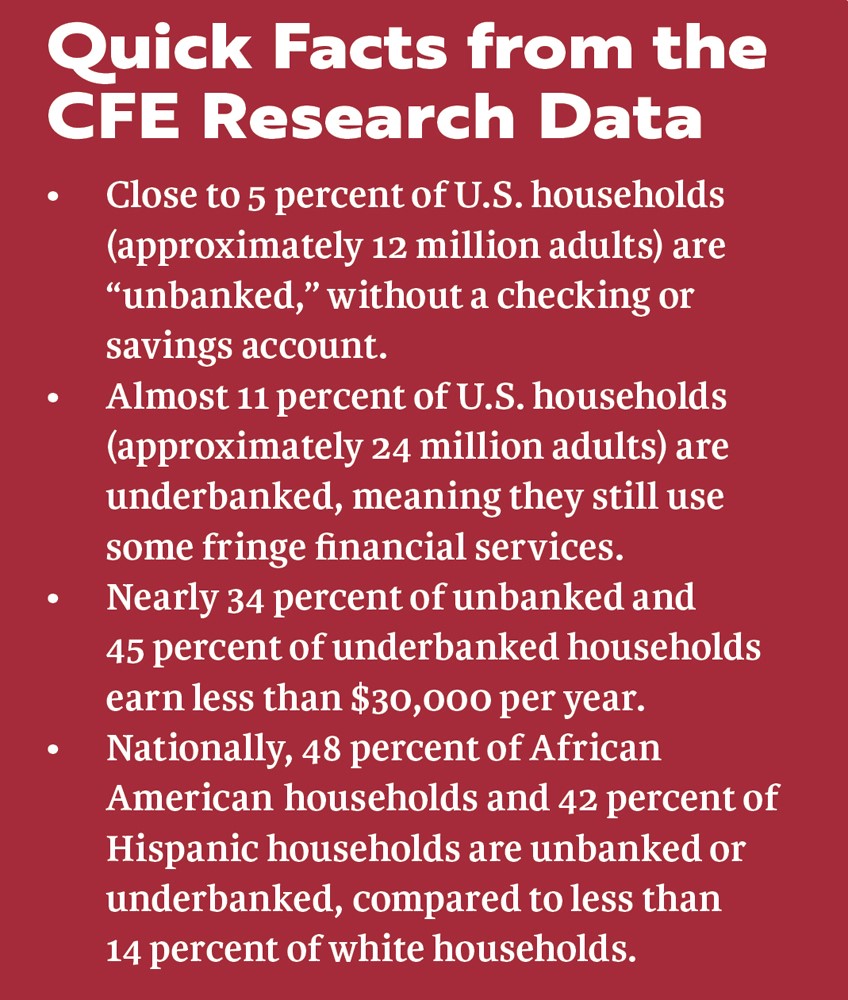

United Bank’s goal is to reach new customers in our communities who are underbanked and bring them into the financial mainstream.

Research reveals many reasons consumers may lack a basic bank account. These include insufficient funds to meet a minimum balance, distrust of financial institutions, or negative history from prior bank relationships. When basic banking services are not available, individuals must rely on expensive alternative financial services, including check cashers, payday lenders, and pawn shops. These individuals and their families can find it challenging to build savings and obtain traditional loans and mortgages.

The American Bankers Association (ABA) and the Georgia Bankers Association (GBA), both of which United Bank is affiliated, encourage participation in the Bank On initiative. United Bank’s participation became a goal of CEO Jim Edwards during his term as ABA Chair. Currently, 199 banks across the United States meet the standards of the program, with more banks added weekly.

United Account customers do not use personal checks to negotiate the funds in their account, only a debit card and electronic bill payment. Furthermore, the account is programmed to prevent most overdraft scenarios.

“Some consumers make costly mistakes with their checking accounts and overdraft service,” explains Lori Tucker, United Bank’s Chief Experience Officer. “Unfortunately, the rapid advances technology provides with debit cards and digital payment apps like Venmo® rarely let the dust settle. Few customers carry a checkbook and transaction register any longer. It’s easy to lose track of the funds you have available.”

United Bank provides free services, such as text balance notifications, mobile banking and a 24-hour automated telephone service that give customers easy access to current account information.

United Bank is pleased to offer The United Account

as a current option for customers. Visit:

accessunited.com/personal/the-united-account to learn more.

United Account customers do not use personal checks to negotiate the funds in their account, only a debit card and electronic bill payment. Furthermore, the account is programmed to prevent most overdraft scenarios.

“Some consumers make costly mistakes with their checking accounts and overdraft service,” explains Lori Tucker, United Bank’s Chief Experience Officer. “Unfortunately, the rapid advances technology provides with debit cards and digital payment apps like Venmo® rarely let the dust settle. Few customers carry a checkbook and transaction register any longer. It’s easy to lose track of the funds you have available.”

United Bank provides free services, such as text balance notifications, mobile banking and a 24-hour automated telephone service that give customers easy access to current account information.

United Bank is pleased to offer The United Account

as a current option for customers. Visit:

accessunited.com/personal/the-united-account to learn more.

There are many reasons why a checking account is important to have. See the top 10 reasons to understand the benefits more.