By Lori Tucker, Chief Experience Officer

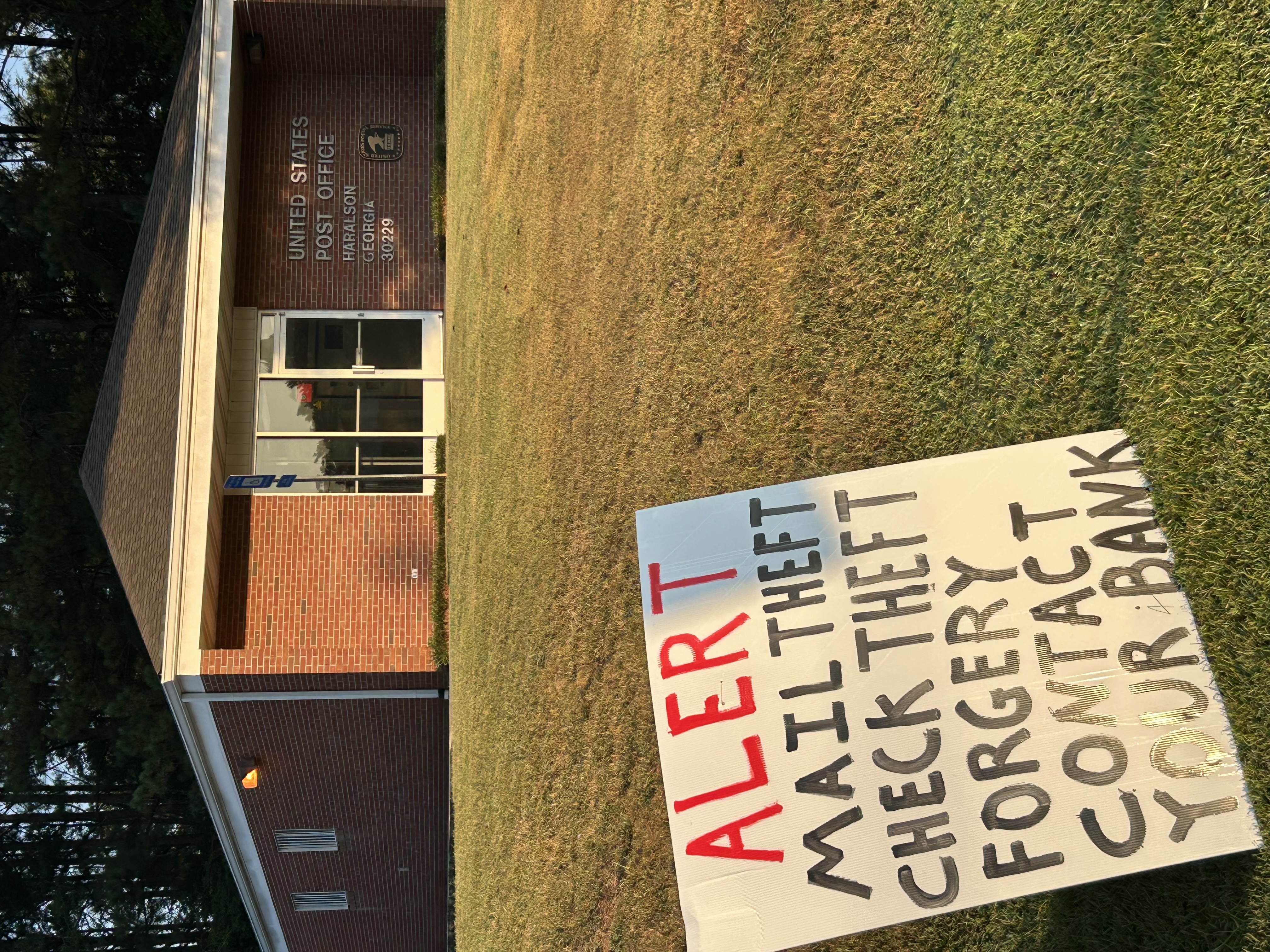

First, it was the blue postal boxes that were robbed. Then, thieves began robbing mail carriers and their trucks. Now, it’s the post offices in our neighborhoods. The bad guys are targeting our mail, hoping to find checks and personal information to steal your identity.

They wash your checks, apply chemicals and try to change the payee and amount. Or they may simply create a new check using the same information with a new payee or amount. The FBI released a warning in partnership with the U.S. Postal Inspector earlier this year. It explains the battle we’re fighting and provides tips to combat postal theft.

Five years ago, the banking industry was fighting debit card fraud and losing millions every year. Today, we’re using better technology and prevention tools, so the crooks have returned to your paper checks. And they’re winning - which means we’re losing.

A recent survey reported that 61 percent of consumers still write checks. What’s more, 24 percent of small businesses have reported being impacted by check fraud.* Those are tough stats, and not all money stolen can be recovered or returned to customer accounts.

Let’s Stop Writing Checks. That might sound impossible to you, but it’s actually very simple. I’ve personally stopped writing any checks. You can do it, too!

Step 1: Study your last 6 months of bank statements. Who did you write checks to?

Step 2: Get to know your digital payment options and choose the best method for your recipient and your comfort level.

- Use a debit card or credit card next time. The debit card will post to your account immediately. Your credit card provider might issue points on those transactions – a bonus! But do this only if you are disciplined and can pay the entire bill each month.

- Load your cards into your mobile wallet on your smartphone. This uses a technology called tokenization. The merchant accepting your payment won’t even have your card number or expiration date.

- Give only trusted companies authorization to debit your bank account directly. This is a great method of payment for those repetitive monthly payments such as utility bills. Some will accept a credit card for payment, too. Just watch out for convenience fees, and make sure you’re disciplined with good credit card management.

- Pay the bill online, using the company’s secure website. You’ll have more control of payment timing if you go directly to your payee’s website and pay your bill online, with a checking account draft or card authorization.

- Use SEND MONEY from your United Bank app. You can safely send money to anyone immediately – you only need their cell phone number or email address. Recipients can receive money directly into their PayPal® account, their Venmo® account or their checking account. This is for sending to a person – not for purchases or paying a company.

- Sign up for online bill payment within Digital Banking. This service is free of charge and provides a platform that saves your payees for repeated use. Just make sure you schedule your payments in advance for adequate processing time so your payments don’t arrive late and incur late fees.

- Use United Bank’s transfer functionality within your digital banking. If you regularly pay another United Bank customer, you can transfer using their account number via the UB to UB Transfer option. Those transfers are immediate, and your payment history is always viewable in your Online Activity in the Service Center. You can only send them money; you can’t draft their account.

- Send a wire transfer. This payment method provides optimal control and protection. It requires a little more effort, much more information, and carries a fee, but for larger amounts, totally worth the investment.

Note: every payment method has $ limits. Most digital transfers have a $2,500 limit.

Why not? The biggest objections that I hear from customers when I have this conversation are:

- They believe digital payments aren’t safe.

- They believe they will open their account up to more unauthorized transactions.

When you write a check, you are giving the recipient (or the thief, if a theft occurs) your account number and bank name, along with your bank’s routing number. Your name and address also provide the information they need to create a counterfeit driver’s license – with their photo. Now they’re even more dangerous.

My point is – a check is the perfect tool of a compromise, for all sorts of unauthorized transactions and more.

Digital transactions are easily monitored. Information provides greater comfort and control. Here at United Bank, we’ve worked hard to provide the digital tools you need to monitor your account easily every day - and they’re all free of charge.

- Download the mobile app and enroll in digital banking. You have 24x7x365 access to your account information. View your accounts daily and notify us if you ever find an unauthorized transaction of any kind. The sooner you let us know, the more likely it is we can stop the payment and protect your account from more occurring.

- Sign up for text alerts. You can set up a text with your account balance every day, or get a text alert anytime your debit or credit card is used. Visit the Text Center in digital banking for more info.

- Sign up for security alerts. You can choose how they are delivered, and these alerts may give you the peace of mind you need to take the digital plunge. Visit the Security Center in digital banking to see the options.

- Set up card controls for your debit and credit cards. You can set transaction limits and turn off international transactions. Go to the Card Center in your digital banking.

- Worried about overdrawing your account with an automated digital payment? Set up an automatic sweep from your savings account. United Bank provides this service at no charge.

Businesses – Sign up for Business Bill Pay, Positive Pay and ACH Origination. Business owners, most of the options above are available to you, too. Business Bill Pay is a powerful tool for paying your vendors and suppliers. ACH Origination allows you to pay employees, vendors and suppliers by direct deposit. And if you must issue a paper check, Positive Pay is your extra level of protection. This service gives you a chance to review all incoming check exceptions and return any that are fraudulent.

Join us in the fight! Let’s turn the table on check fraud and protect ourselves against these fraud schemes. If you’re uncertain how to get started, our bankers are here to help. Visit any United Bank office or call us at 770.567.7211. Our digital support team is available seven days a week, from 7am until 8pm.

*From Abrigo’s State of Fraud publication, 2024.